Compelling Investment Opportunity

Over the last decade, the opportunity within private credit has grown substantially. As banks and other traditional lenders have played a diminishing role in lending to small and mid-sized companies, credit-focused investment firms have stepped in to fill the void.1

With three decades of experience in credit investing, Oaktree has the depth and breadth necessary to meet the growing demand for private credit—and the potential to deliver attractive outcomes for investors.

1Please see prospectus for additional risk factors related to investments in privately owned small- and medium-sized companies.

A Diversified Portfolio of Credit Opportunities

The Oaktree Strategic Credit Fund will primarily invest in private credit opportunities, and it will also strategically invest in discounted, high-quality public investments to enhance total return and provide liquidity in times of market dislocation.

- Sponsored financings

- Non-sponsored financings

- Opportunistic lending

- High-yield bonds

- Senior loans

For illustrative purposes only and subject to change.

A Flexible Approach to Identifying Income Opportunities

Sponsored

Financings

Opportunity

Provide flexible financing solutions for private equity-owned businesses

Example

Private equity firm focused on the software or healthcare sector

Non-Sponsored

Financings

Opportunity

Highly structured private loans to primarily founder-owned businesses

Example

Bespoke, proprietary loan to a company that cannot access bank financing

Opportunistic Lending

Opportunity

Loss-protected loans to companies requiring tailored financial solutions in periods of market dislocation

Example

Term loan to energy company with long-term stability temporarily impacted by COVID-19 headwinds

Public

Debt

Opportunity

Senior debt securities, such as high-yield bonds and senior loans, impacted by market dislocations or sector-focused headwinds

Example

Hospitality company's debt undervalued due to lack of travel

Dynamically Allocating in Response to Changing Market Conditions

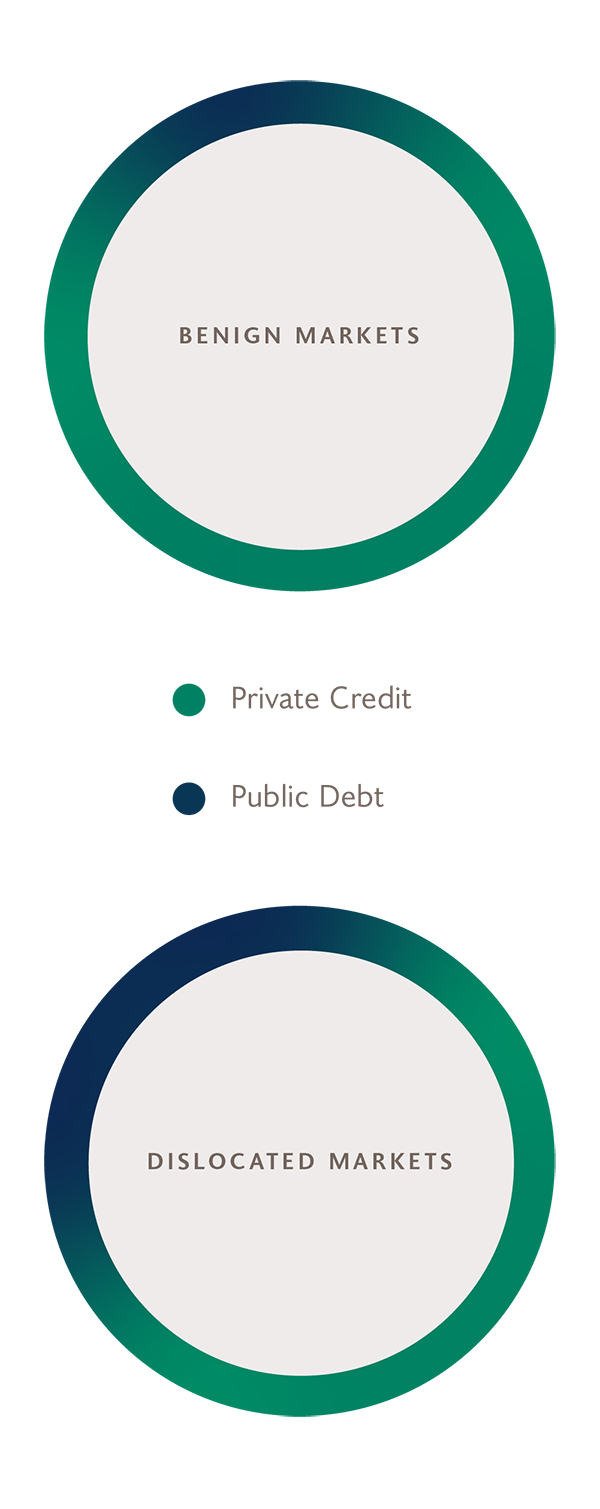

Our active approach involves dynamically allocating to private and public credit opportunities in response to changing market conditions. In relatively calm, or “benign," market conditions, the Fund generally has a higher allocation to private credit to generate income and mitigate risk. In periods of stress, or "dislocated" market conditions that can cause mispricing of assets, the Fund will increase its allocation to public investments to capture total-return opportunities.

For illustrative purposes only and subject to change.

Attractive outcomes

Individuals can invest in the Oaktree Strategic Credit Fund through a simple, accessible structure with the following attractive features:

Liquidity1

Distributions2

Pricing

1099-DIV

1Quarterly tender offers are expected but not guaranteed. Please see disclosures and the Fund's prospectus for more information.

2There is no assurance monthly distributions paid by the Fund will be maintained or paid at all. Please see disclosures and the Fund's prospectus for more information.

Terms3

| Structure | A non-diversified, non-traded, closed-end management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 |

| Portfolio | Target ~70% in private loans and up to 30% in discounted, high-quality public investments to enhance total return in times of significant market dislocation; at least 80% in credit investments |

| Minimum Investment | $2,500 |

| Suitability | Either (1) a gross annual income of at least $70,000 and a net worth of at least $70,000 or (2) a net worth of at least $250,000. Certain states have additional suitability standards. Please see Oaktree Strategic Credit Fund’s prospectus for more information. |

| NAV Frequency4 | Monthly |

| Subscriptions5 | Monthly |

| Distributions6 | Monthly (not guaranteed, subject to board approval) |

| Liquidity7 | Quarterly (not guaranteed, subject to board approval), subject to quarterly cap of 5% of common shares outstanding (either by number of shares or aggregate NAV) |

| Management Fee | 1.25% per annum on NAV |

| Incentive Fee | • 12.5% of net investment income, subject to 5% hurdle and catch-up (paid quarterly) • 12.5% of realized capital gains, net of realized and unrealized losses (paid annually) |

| Leverage | Target leverage of 0.85x to 1.0x debt-to-equity; 2.0x regulatory cap |

| Tax Reporting | Form 1099-DIV |

3Terms summarized herein are for informational purposes and qualified in their entirety by the more detailed information set forth in Oaktree Strategic Credit Fund’s prospectus. You should read the prospectus carefully prior to making an investment.

4Oaktree Strategic Credit Fund intends to sell its common shares at a net offering price that it believes reflects the net asset value per share as determined in accordance with Oaktree Strategic Credit Fund's share pricing policy. Oaktree Strategic Credit Fund will modify its public offering price to the extent necessary to comply with the requirements of the Investment Company Act of 1940, including the requirement that Oaktree Strategic Credit Fund does not sell its common shares at a net offering price below its net asset value per share (unless Oaktree Strategic Credit Fund obtains the requisite approval from its shareholders). To the extent there is a possibility that Oaktree Strategic Credit Fund could sell shares of any class of its common shares at a price which, after deducting any upfront sales load, is below the then-current net asset value per share of the applicable class at the time at which the sale is made, the board of trustees or a committee thereof will elect to either (i) postpone the closing until such time that there is no longer the possibility of the occurrence of such event or (ii) determine the net asset value per share within two days prior to any such sale, in each case, to ensure that such sale will not be at a price which, after deducting any upfront sales load, is below the then-current net asset value per share of the applicable class.

5Orders for purchases will be accepted on the first day of each month. Subscription requests must be received at least five business days before the first day of each month and NAV will be available generally 20 business days after the effective date of the purchase. Because subscriptions must be submitted at least five business days prior to the first day of each month, investors will not know the NAV per share at which they will be subscribing at the time of subscription. See Oaktree Strategic Credit Fund's prospectus for more information.

6There is no assurance Oaktree Strategic Credit Fund will pay distributions in any particular amount, if at all. Any distributions Oaktree Strategic Credit Fund make will be at the discretion of its board of trustees. Oaktree Strategic Credit Fund may fund any distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, and Oaktree Strategic Credit Fund has no limits on the amounts it may pay from such sources. Oaktree Strategic Credit Fund believes that the likelihood that it pays distributions from sources other than cash flow from operations will be higher in the early stages of the offering.

7Liquidity is provided through Oaktree Strategic Credit Fund’s share repurchase plan, which is subject to board discretion, has quarterly limits, and may be suspended. To the extent Oaktree Strategic Credit Fund offers to repurchase shares in any particular quarter, shares held for less than one year and tendered for repurchase will be repurchased at 98% of NAV.

SHARE CLASSES & FEE STRUCTURES

| Class S Shares | Class D Shares | Class I Shares | |

|---|---|---|---|

| Availability | Through transactional brokerage accounts | Through fee-based (wrap) programs, broker-dealers, registered investment advisers, and bank trust departments | Through fee-based (wrap) programs, endowments, foundations, pension funds and other institutional investors, broker-dealers |

| Maximum Upfront Sales Charge8 | up to 3.5% | up to 1.5% | N/A |

| Maximum Early Repurchase Deduction9 | 2.0% | 2.0% | 2.0% |

| Ongoing Shareholder Servicing and/or Distribution Fee | 0.85% per annum, calculated on NAV, paid monthly | 0.25% per annum, calculated on NAV, paid monthly | N/A |

| Minimum Initial Investment10 | $2,500 | $2,500 | $1,000,000 |

8No upfront sales load will be paid with respect to Class S shares, Class D shares or Class I shares, however, if you buy Class S shares or Class D shares through certain financial intermediaries, they may directly charge you transaction or other fees, including upfront placement fees or brokerage commissions, in such amount as they may determine, provided that selling agents limit such charges to a 1.5% cap on NAV for Class D shares and 3.5% cap on NAV for Class S shares. Selling agents will not charge such fees on Class I shares. Please consult your selling agent for additional information.

9Liquidity is provided through Oaktree Strategic Credit Fund’s share repurchase plan, which is subject to board discretion, has quarterly limits, and may be suspended. To the extent Oaktree Strategic Credit Fund offers to repurchase shares in any particular quarter, shares held for less than one year and tendered for repurchase will be repurchased at 98% of NAV.

10Select broker-dealers may have higher suitability standards, may not offer all share classes, or may offer shares at a higher minimum initial investment.