Global Leader in Alternative Investing

Oaktree is a leading global alternative asset manager with deep expertise in a broad yet specialized array of credit strategies.

As of September 30, 2025

Oaktree Capital Management, L.P., is a leading global investment management firm headquartered in Los Angeles, California focused on less efficient markets and alternative investments and is an affiliate of Oaktree Strategic Credit Fund's investment adviser, Oaktree Fund Advisors, LLC (the "Adviser" and, collectively with its affiliates, "Oaktree")

Competitive Private Credit Platform

Benefiting from robust firm-wide sourcing and origination power, Oaktree’s specialized investment team leverages strong relationships with sponsors and potential borrowers around the globe. These key capabilities—in combination with preeminent credit expertise built over three decades—often make Oaktree a first point of contact creating preferential access to deal flow and the ability to maintain a high degree of investment selectivity.

and Sourcing Team

Lending Experience

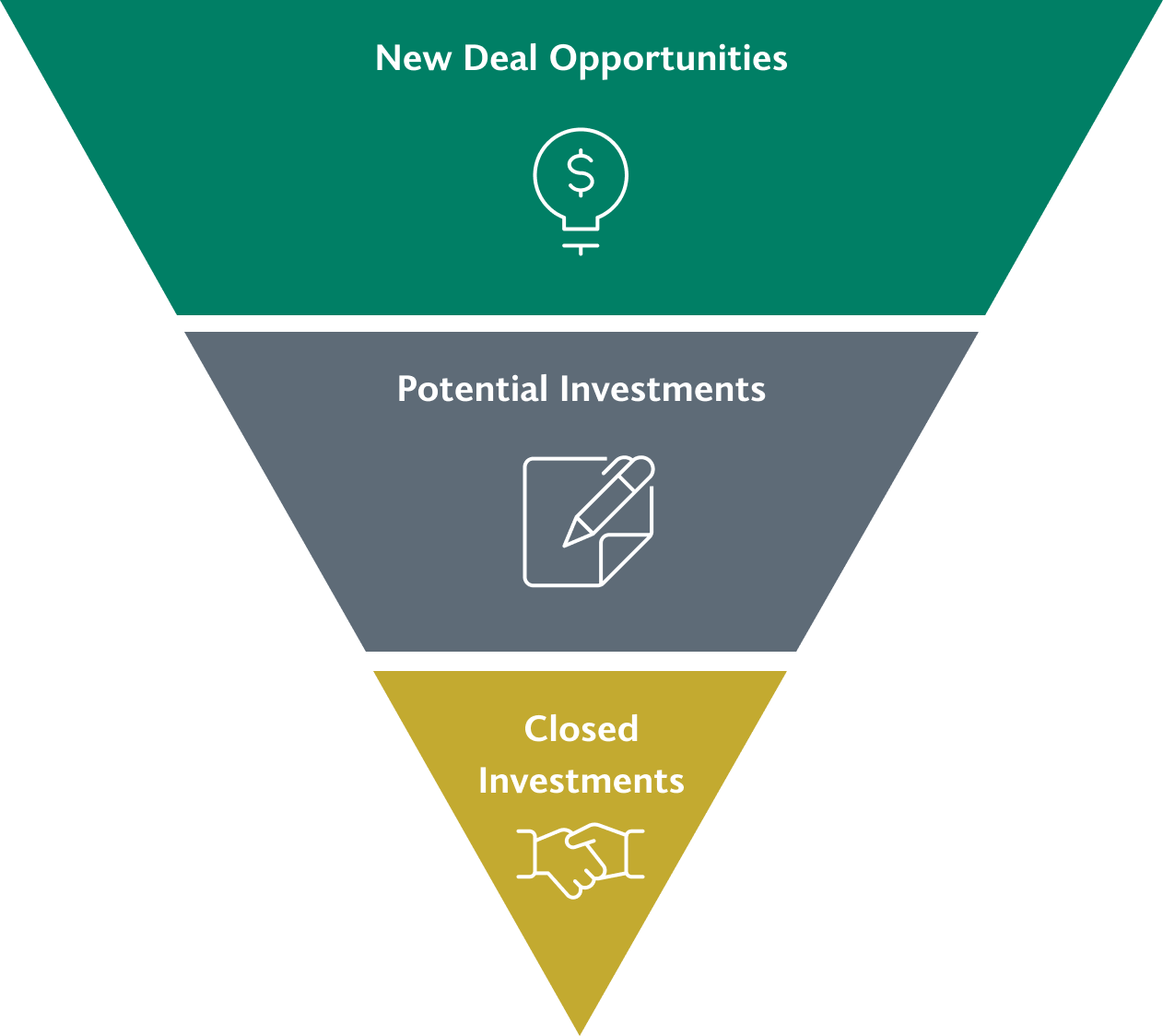

Highly Disciplined Approach to Credit Selection

New Deal Opportunities

Evaluate opportunities sourced through multiple proprietary sourcing channels

Potential Investments

Complete rigorous due diligence on a subset of opportunities that pass initial screening

Closed Investments

Identify income-producing opportunities for the Fund

Unwavering Focus on Risk Management

Oaktree is unified by a single investment philosophy, placing primary emphasis on risk control and consistency, which has helped deliver attractive outcomes for investors throughout market cycles.